Professional Accountancy Organization (PAO) Development

Sustainable Organizations & Sustainability Transformation

The call for finance to be a ‘force for good’ has reached the forefront, and the Islamic finance industry is heeding that call.

Islamic finance is one of the fastest growing areas of the global financial services industry and has even spread into western markets (e.g. Luxembourg). Islamic finance represents USD 2.5 trillion (DinarStandard, 2019) and is expected to exceed USD 3 trillion by 2020 (Martínez-Solimán, 2017), a portion of which could be mobilized for development. Dr. Mohamed Damak, Senior Director & Global Head of Islamic Finance, reported that S&P Global Ratings indicate that the global Islamic finance industry will expand by approximately 10%-12% between 2021-2022.

The main differences between Islamic finance and conventional finance, is that for the former:

- Sharing of profit is correlated to risk sharing between parties

- Speculation in transactions is prohibited

- Interest is prohibited

- Transactions are asset-based or asset-backed.

Overall, Islamic finance can be an alternative to conventional financial products as a form of socially responsible and/or ethical investing.

Opportunities for Donors

In 2015, the international community adopted the Sustainable Development Goals (‘SDGs’) as a universal call to end poverty, protect the planet and ensure prosperity for all by 2030. Since inclusion, women’s empowerment, accountability, and sustainability are embedded in Islamic Finance’s principles, it offers a natural link with the SDGs.

Islamic finance can ensure that more financial resources are mobilized in a sustainable way for the SDGs, in a way that is more inclusive. Harnessing zakat and waqf flows could be a first step in mobilizing these flows towards the SDGs and towards underfunded humanitarian and development needs.

Image

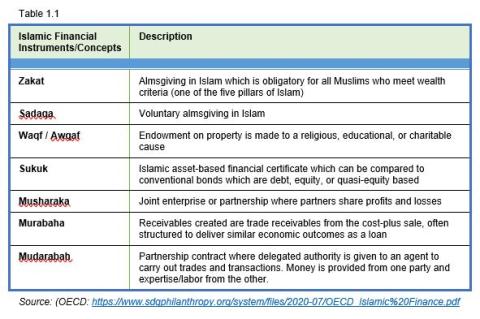

The OECD published a policy paper in June 2020 which identifies opportunities that Islamic finance presents for donors as they look to deliver the SDGs. There are opportunities to expedite the delivery of SDGs through the use of Islamic finance concepts and tools (see table 1.1 for a description of the instruments). The United Nations Development Programme (UNDP) key findings to date indicate that there are five Islamic financial instruments with high potential – sukuk (bonds), waqf (charitable endowment), zakat (mandatory form of giving) and corporate social responsibilities – which can be combined with microfinance, cryptocurrencies, and other modern mechanisms (sukuk have been using blockchain technology since 2017).

Opportunities for Professional Accountancy Organizations (PAOs)

As the sustainable finance sector grows and becomes more prevalent, PAOs will be at a disadvantage if they don’t participate. PAOs have an opportunity to consider how they can get their members and Islamic banks to be equipped with the right knowledge.

As previously mentioned in the article titled ‘How Islamic Finance Can Facilitate Public Finance Recovery & Growth’, PAOs such as the Malaysian Institute of Accountants (MIA), led by the MIA Islamic Finance Committee and the Malaysian Accountancy Research and Education Foundation, are already increasing the supply by attracting, educating, and training accounting professionals versed in Islamic Finance that are able to provide the services needed. The Saudi Organization for Chartered and Professional Accountants (SOCPA) is another example, which is currently developing the next generation of Islamic bankers who understand the dynamics of sustainable finance, who understand climate change, net zero carbon footprint, social finance and inclusion. More PAOs in the region, particularly in the Gulf sub-region and East Asia, are following suit and championing the concepts.

In early 2022, IFAC staff met with representatives from SOCPA—Dr. Musab Al-Jaid, Executive Director of Membership and Professional Qualification; Dr. Musab Al-Naim, Member of the Education and Training Committee; and the Executive Advisor Mr. Abdul Mohsen al-Zaben—to support SOCPA in aligning educational outputs with the labor requirements. SOCPA indicated that it is currently gearing up to launch its model education curriculum for adoption by all Universities in Saudi Arabia to raise the quality of accountancy and finance education, increase the number of qualified graduates, and enable economic sectors to obtain appropriate accounting and auditing services to keep up with the social, economic, and technical developments at the global and regional levels. In its study, SOCPA reports that accounting students in Saudi Arabia already receive training on Islamic finance, and it aims to provide an even higher level of knowledge for accounting graduates by 2030 (Saudi Vision).

Most recently, in response to the market demand, SOCPA included a zakat accounting course on how to prepare a Zakat declaration as well as practical knowledge of zakat legislation and principles. SOCPA also included a course on sustainability and accounting and how to maximize environmental, social, and governance (ESG) performance within the Shari’ah context.

Challenges for Islamic finance in addressing sustainability

Disclosure is likely the main challenge that Islamic financial institutions currently face in fully embracing the sustainability agenda. Only a handful have committed to globally recognized frameworks such as the UN Principles of Responsible Investment and the UN’s Principles of Responsible Banking, both of which require detailed reporting of one’s sustainability efforts and impact. However, the trend toward doing good for the planet is attracting Islamic finance institutions to capitalize on the increasing demand of reaching a wider investor base—which is often the driving reason to turn to Islamic sustainable finance in the first place.

Call to Action

One of our objectives this year will be to engage with relevant PAOs and stakeholders to identify how Islamic finance instruments have been used in various countries towards achieving the SDGs. The purpose is to inform our advocacy and capacity building activities and we anticipate that this work will lead to enhanced dialogue that brings together donors, policymakers, PAOs, and other industry players to unlock investment opportunities for developing countries.

Stay tuned, more to follow!

If you have any examples of how Islamic finance instruments are being used in your country towards achieving SDGs, please contact DanaJensen@ifac.org.

Sources

Martínez-Solimán, M. (2017), Islamic Finance: An Innovative Avenue For Financing The Sustainable Development Goals

OECD (2020), How Islamic Finance Contributes to Achieving the Sustainable Development Goals

S&P Global Ratings (2022), Islamic Finance Outlook: 2022 Edition