Image

The International Federation of Accountants (IFAC), the Association of Chartered Certified Accountants (ACCA), and the Chartered Accountants Australia and New Zealand (CA ANZ), in collaboration with the OECD, have partnered again to explore how attitudes and perception of tax policies differ amongst the public. This year’s survey adds important new questions on the connection between trust in tax and corruption and views on the role of tax in sustainable development.

A global webinar launched the 2023 edition of the Public Trust in Tax series on September 14, 2023. It was attended by an engaged audience of over 500 live participants from over 120 jurisdictions. Watch the full recording of the event here.

Understanding public attitudes towards tax systems and the actors involved

IFAC, ACCA, and CA ANZ have run a series of ground-breaking online surveys since 2017 seeking to understand public opinion on a range of tax relevant matters across the G20. These biennial surveys have reflected the views of over 7,600 people across the G20 countries plus New Zealand, providing a real insight into who responders trust and what concerns them.

For the most recent report launch, IFAC, ACCA and CA ANZ, working in collaboration with the OECD, convened global experts, thought leaders and practitioners from around the globe to discuss “Building Trust in Tax for a Sustainable Future: The Role of Tax in Fighting Corruption and Promoting Sustainable Development”.

Who do people trust?

Image

Image

Jason Piper, Head of Tax and Business Law, ACCA presented the key finding of the survey:

“We asked people how much they trust, or distrust, eight key groups--professional tax accountants, professional tax lawyers, NGOs, government tax authorities, media reports, social media and politicians. We see accountants as the most trusted group, both in absolute and net terms, and politicians at the other end of the same scale. Government tax authorities enjoy the third highest levels of positive trust, though they also have comparatively high levels of distrust”.

Image

Helen Brand, Chief Executive of ACCA, said: “We all have a part to play in building trust in tax. For the accountancy profession, our role is clear. Accountants remain the most trusted actors, and it is vital that every step is taken to maintain that trust, and to use it to improve the effectiveness of tax systems in supporting the communities in which we all live.”

“Accountants are vital to creating the records on which taxes are based. Transparency about how those processes work, and accountability for when they don’t, is fundamental for the legitimacy of tax systems,” she pointed out.

Image

Ainslie van Onselen, Chief Executive of CA ANZ added: “Professional accountants have the skills needed at every level to help businesses embrace a new way of measuring and reporting on the impact they have on society and the environment – and to adapt tax systems to reflect those priorities. As the most trusted actors in the tax field, they are also best placed to explain those changes to all the affected parties, and to help with the transition to those new models.”

“It won’t be an easy journey, but CAANZ, ACCA and IFAC are committed to working with our own members and with others to build public trust in tax systems fit for a sustainable future,” she promised.

Image

The event continued with a panel discussion, moderated by Scott Hanson, Director of Policy and Global Engagement at IFAC. The discussion centered around the new survey questions related to the connection between trust in tax and corruption and the role of tax in sustainable development. The panel featured:

- Delia Ferreira Rubio, Chair of Transparency International (TI);

- Joseph Stead, Senior Tax and Development Policy Analyst at the OECD Centre for Tax Policy and Administration;

- Jens Poll, Member of the International Ethics Standards Board for Accountants (IESBA); and

- Mamiky Leolo, Executive Manager of the Macroeconomic Research Unit at the National Revenue and Compliance Management Division of the South African Revenue Service.

All speakers agreed that trust is vital for any tax system to work. Building and maintaining trust therefore needs to be a priority for all who work in tax, whether tax administrators or advisors, and “taxpayers need to think about their responsibilities too,” highlighted OECD’s Joseph Stead.

“Transparency and accountability are antidotes to remove the barrier to trust,” said Mamiky Leolo, from the South African Revenue Service. Panelists also highlighted that understanding people’s lived experience of tax systems is vital to both developing policy change and implementing it. “Tax policy should be built on evidence, not anecdote,” ACCA’s Jason Piper mentioned.

The discussion confirmed that professional accountants must embrace their role in building mutual trust between taxpayers and tax administrations. TI’s Delia Ferreira Rubio also highlighted “the importance of accountants and lawyers in keeping their role as gatekeepers of the system and avoiding the risk of becoming enablers of corruption.”

This requires to the public to be able to trust intermediaries like professional accountants, who, according to IESBA member Jen Poll, “to maintain this trust, must test every day that they have, and that there is reason for that trust.” High quality standards and the right frameworks in place will help maintain that trust.

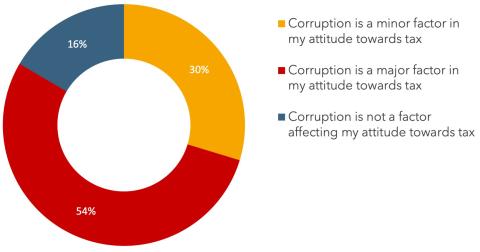

The impact of corruption on trust in tax

Image

This year, for the first time, respondents were asked about the impact of corruption on their attitude towards tax. People see tax systems as a mechanism for positive change but are concerned about corruption. A clear majority, 53.8%, consider it a major factor.

Discussing corruption’s relationship to tax systems, Joseph Stead said, “Corruption is not a problem that only affects developing countries or the global South. There are big concerns around corruption in OECD countries as well. We must always be on our guard against corruption.”

Delia Ferreira Rubio agreed: “Corruption is a global problem. The money which is lost in corruption in underdeveloped countries or developing countries ends in the city of London, the real estate industry in New York or Canada, or the art markets in Geneva. We must fight together. This is a collective action endeavor”.

Jens Poll touched on the question of ethics, which is broader than the law and can guide behaviors. “There are two specific roles for the professional advisor in fighting for transparency and accountability: first as a skilled gatekeeper, and second as an ‘educator’, using his/her professional expertise to develop an ethical attitude and behavior, as well as a culture of integrity”.

Commenting on what can tax authorities do to improve trust, Mamiky Leolo suggested several ways to strengthen tax administration’s combat against tax evasion, money laundering, and illicit financial flows: “We recommend an evolutionary and interdisciplinary approach to legislation and regulation, through both analyzing the reactions to changes in regulations, enabling readjustment, and through analyzing tax policy and regulation from an economics, accounting, law, sociology, psychology, political science and public administration perspective, Cooperation and engagement at the international level, and then engagement with the taxpayers at the domestic level, are crucial”, she insisted.

The role of tax in sustainable development

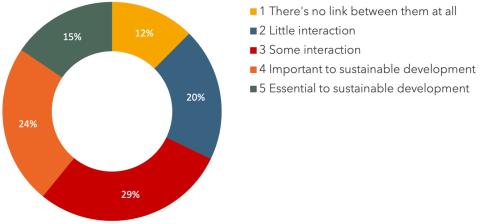

Image

Two more questions were asked for the first time in this year survey:

- To what extent are taxes connected to sustainable development; and

- To what extent would you be prepared to pay more taxes to support sustainable development goals.

The results shows that 68% of respondents see at least some connection between tax and sustainable development, and that 57% would be prepared to pay more in taxes to support it.

Joseph Stead said that tax revenues are the single largest source of development finance. And yet the revenues are not sufficient. “So how do we go about increasing taxes? And how do we make sure this will deliver real benefits to citizens?” he asked. “We need to holistically look at the whole of the tax system on where to raise revenues. And sometimes the answer may not be tax in this area. We need to properly consider the policies first and identify if there are better alternatives to a tax, especially when we’re looking at changing behaviors, bearing in mind inequality.”

Mamiky Leolo added: “An important aspect of the environmentally related taxes concerns the appropriate tiers of government at which these instruments should be imposed. As a general rule, we should clearly avoid having a proliferation of levies that are introduced on an ad hoc basis. There needs to be coherence, not only for economic growth but also for economic development.”

For the panelists, environment and sustainable development related taxes must be well conceived, well designed, and well implemented. Any reform in that field should always try and be as balanced as possible and must not place a disproportionate burden on those that are poor or vulnerable in society.

Delia Ferreira Rubio repeated that tax is not just an isolated measure aimed at raising money. “Taxation is part of public policies and as such its design and implementation need to take into account the purpose of the policy, its potential effects, and the conditions needed for the policy to be effective. Tax incentives are a good tool to achieve certain taxpayers' responses if they are accompanied by transparency and accountability to avoid them being just checkbox-ticking exercises”, she warned.

Jens Poll informed the audience that the IESBA has a new project- for which an exposure draft is expected in December about the role of accountants in sustainability reporting and sustainability assurance. “While as per the International Code of Ethics “professional accountants in business and in public practice are acting in the public interest”, there is a need for more guidance and application material, because the sustainability environment is different from the old financial one - you are acting with different people, with different stakeholders,” he explained.

Image

Kevin Dancey, CEO of IFAC concluded the event: “I’m proud to see the sustained high levels of trust in professional accountants. But there is no room for complacency, and we will continue to engage with key stakeholders--including the younger generation--to support financial education and literacy, and drive trust in tax and trust in our profession--all in the public interest.

At IFAC, and through PAOs like ACCA and CA ANZ, we will continue to do our part to enhance the effectiveness of tax systems and, grounded in the Profession’s International Code of Ethics, support professional accountants--whether in government, business or public practice--in delivering their public interest mandate and doing the right thing.”

USEFUL RESOURCES

IFAC, ACCA and CA ANZ

IESBA

OECD

- Tax Morale II : Building Trust between Tax Administrations and Large Businesses

- OECD work on tax and crime

- OECD Tax Co-operation for Development 2022

Transparency International

-

Gatekeepers video