Professional Accountants in Business (PAIB)

Sustainable Organizations & Sustainability Transformation

Michael Mills, Finance Director of Strategy and Sustainability at Jaguar Land Rover (JLR) Automotive PLC, presented at the IFAC Professional Accountants in Business Advisory Group meeting in September 2023. Delving into the dynamic intersection of finance and sustainability within JLR, he highlighted JLR's commitment to ambitious sustainability goals, the vital role of the finance function in driving the sustainability agenda, and the challenges and opportunities in recruiting finance professionals with deep sustainability knowledge. The case study underscores the importance of professional accountancy organizations (PAOs) as key partners in fostering skills and capacity to meet the evolving demands of sustainable business practices.

Key points:

- JLR is committed to ambitious science-based targets to reduce its greenhouse emissions and become carbon net zero across its supply chain, products, and operations by 2039.

- Sustainability is at the heart of JLR’s strategy and competitive positioning, and embedded into all its decisions and activities.

- The finance function plays a proactive role in driving the sustainability agenda in JLR and identifies opportunities to influence and lead activity within the sustainability strategy.

- Bridging sustainability and finance knowledge is a requirement in both the corporate and investor communities, and there is a high demand for finance professionals with deep sustainability knowledge.

- Recruiting finance professionals with adequate sustainability knowledge is a challenge. JLR is partnering with professional accountancy bodies (PAOs) to help support and train JLR finance staff.

- PAOs are key partners in building skills and capacity to meet the needs of business. However, they need to accelerate the support of their members beyond compliance requirements to understand and deliver best practices and sustainability solutions.

JLR is a luxury automotive company owned by Tata Group with four core brands: Range Rover, Defender, Discovery, and Jaguar.

Sustainability is at the heart of JLR’s strategy and embedded into all its decisions and activities across product and services, manufacturing and supply chain. JLR’s Reimagine strategy focuses on a roadmap to transform the business and become carbon net zero across its supply chain, products, and operations by 2039. JLR is committed to ambitious science-based targets to reduce its greenhouse emissions by 46 percent in its operations and by 54 percent per vehicle across its entire value chain by 2030.

Electrification is central to JLR’s decarbonization roadmap with a commitment to introduce all-electric variants to all four brands and the supporting ecosystem of suppliers and infrastructure by 2030. Enhancing circular economy capabilities and establishing circular economy targets are also central to the roadmap.

Within Tata group and JLR, sustainability is seen as an opportunity to be more competitive in the market, respond to customer expectations (e.g., moving from leather to synthetic materials), and have a positive impact on sustainable development.

JLR’s sustainability governance structure starts with the oversight of the JLR Limited Board and the JLR Board of Directors, and JLR executive leadership participates in Tata Group’s Sustainability Group and Sustainability Working Council (JLR’s sustainability governance and Reimagine strategy are further explained in JLR’s Annual Report 2023).

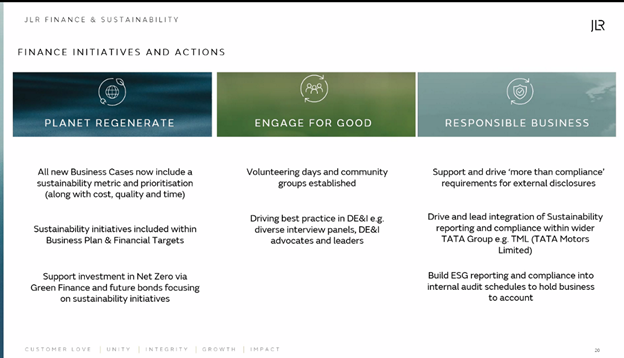

JLR’s Reimagine strategy encompasses three sustainability focus areas:

- Planet regenerate – Transforming the business across the full value chain

- Engage for good – Acting as a global citizen for sustainable development in the communities and environments in which it operates

- Responsible business – Doing business responsibly and with integrity

Key priorities in each of the focus areas

Planet Regenerate – to deliver significant steps towards net zero

- Enhance governance with the digitalization of sustainability – investing in a platform to report and predict sustainability KPIs prior to product launches, integrating sustainability data into JLR systems to support decision-making across the business, and automating measurement and reporting with digital solutions to reduce scope 1, 2 and 3 GHG emissions (such as through smart meters) to replace CO2 estimates with real-world data

- Embed circular economy into business practice – drive decoupling resource use from value creation, and accelerate embedding of circularity principles (through Ellen MacArthur Foundation partnership and the World Economic Forum circular cars initiative) from an engineering and design perspective creating value beyond the product in use today through recycling, re-sourcing, and re-use, and zero waste to landfill

- Implement industry-leading strategy for nature and biodiversity – setting science-based targets for nature, training employees, and partnering with NGO to help deliver solutions.

Engage for Good – Giving back to local communities

- Established the JLR Foundation to deliver positive community impact through grant awards

- Support Tata Group’s ambition to have one of the best volunteering programs by 2025

- Drive positive and environmental impacts through NGO partnerships, for example to drive strategic actions relating to biodiversity and nature

- Mobilize circularity and technology for a reinforcing ecosystem to deliver positive impacts in the value chain

- Drive cohesive enterprise-wide Engage for Good activity through a united decision-making framework and citizenship fund.

Responsible Business – beyond compliance

- Decrease risk and increase “brand love” through best-in-class sustainability content for the annual report and supporting disclosures

- Manage and mitigate risk with a comprehensive, data-led process

- Implement comprehensive policies, standards and action plans across all material ESG topics

- Proactively engage with emerging ESG policy and legislation.

Finance driving the sustainability agenda in JLR

The JLR Finance Mission incorporates two key areas

- Protecting value – improving balance sheet confidence, achieving best-in-class finance processes through digitalization and automation, building confidence that banks, rating agencies and investors have in JLR, and risk management and effective compliance (covering audit, regulations, accounting and tax)

- Growing value – partnering with the business to increase customer loyalty, supporting engineering, design, and procurement teams in product development, and with logistics and manufacturing to enhance the efficiency of product delivery including reducing product lifecycles from seven years with agile management tools and techniques.

The finance function partners with the business team to understand the total impact of JLR’s activities across the value chain. For example, they work together to improve supply chain and distribution activities and reduce impact which involves:

-

Assessing supplier performance and collecting relevant data from suppliers on sourced parts, nature of raw materials, manufacturing process and energy sources as input into the supplier sourcing strategy and identifying high risk suppliers. A key metric is understanding CO2 output by part.

-

Working with freight and distribution partners for air and marine transportation to understand how they plan to reduce emissions, and whether new operating models can reduce total impact.

The CFO is driving the leadership of the JLR finance team in sustainability so that sustainability factors are treated on an equal basis as cost, quality, and time criteria in decision-making. The finance team has identified various opportunities to influence and lead activity within the sustainability strategy. Its contribution to the three core sustainability pillars involves:

- Incorporating sustainability into business planning and financial targets linking cost and quality targets with sustainability targets

- Leveraging green finance opportunities to enable investment in sustainability initiatives including renewable energy

- Driving best practices in diversity, equity & inclusion (DE&I) within the finance team and across the organization

- Going beyond compliance requirements for external disclosures, integrating and enhancing sustainability reporting across Tata group leveraging JLR’s experience

- Building ESG reporting and compliance into internal audit schedules to hold the business to account.

Finance professionals and capability

Recruiting accounting and finance professionals with adequate sustainability knowledge in the current jobs market is challenging. JLR is partnering with PAOs to help support and train JLR finance staff, and help provide the confidence they need to take on new roles in support of the sustainability strategy. JLR has also created a finance sustainability network to drive engagement, interest and alignment of finance staff with the sustainability agenda.

PAOs are key partners in building skills and capacity to meet the needs of business. However, they need to accelerate the support of their members beyond compliance requirements to understand and deliver sustainability solutions.

In conclusion, the case study of Jaguar Land Rover (JLR) exemplifies the imperative for businesses to integrate sustainability into their financial strategies and operations and the critical role of finance professionals in this journey. Collaborative efforts with professional accountancy organizations and a shared commitment to advancing sustainability best practices underscore the pivotal role of finance functions in shaping a more sustainable and responsible business landscape.

Explore more insights from the PAIB Advisory Group.