On 13 July 2023, international public sector experts explored how governments are professionalizing their finance functions and building their capacity and capabilities – as well as discussing attraction and retention challenges and opportunities.

According to a Global Guide for Professionalisation in Public Sector Finance, published by ACCA and IFAC, achieving professionalisation benefits economies, governments and individuals. The reports clearly highlights that public financial management (PFM) reforms will only be achieved if finance professionals have the right skills and knowledge and if the public sector is able to attract and retain the right people. But this is becoming more challenging in a world where the public sector is increasingly competing for talent, despite the tangible advantages of a finance career in the public sector, as highlighted in the latest ACCA’s Global Talent Trends 2023: Public Sector report.

These crucial issues were discussed at a global webinar co-hosted by IFAC and ACCA that attracted nearly 400 live participants from over 110 countries. The highly engaged audience provided valuable input for our experts.

Laura Takamizawa, Principal at IFAC set the scene: “Investing in professionalisation of the finance workforce is key to creating an enabling environment for PFM reforms to succeed, as well as creating strong CFOs and finance functions to effectively and efficiently manage public finances and enhance public service delivery.”

“The accountancy profession, in collaboration with other stakeholders, must drive and enable professionalisation and related goals, such as increased diversity, which is particularly important in a public sector context to ensure that decisions made are representative of society as a whole,” she added.

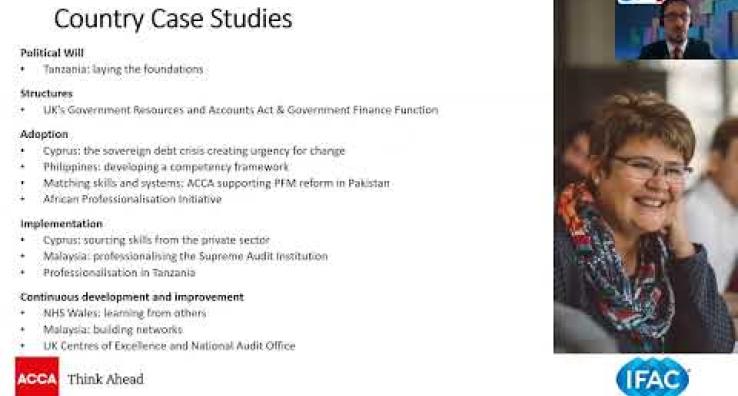

Alex Metcalfe, Global Head of Public Sector at ACCA, presented an overview of the joint ACCA-IFAC Global Guide for Professionalisation in Public Sector Finance, including its high-level roadmap for implementing professionalisation.

"Governments must invest now in the professionalisation of their finance functions, so that their PFM systems are flexible and resilient enough to deal with future crises.”

The panel discussion, moderated by Laura Takamizawa, welcomed:

Image

- Tracey Carroll, First Assistant Secretary of the Shared Services Transformation Program Office at the Australian Government’s Department of Finance;

- Ed Olowo-Okere, Senior Adviser in the Equitable Growth, Finance, and Institutions (EFI) Vice Presidency at the World Bank;

- Dónal Mulligan, Policy Analyst in the OECD’s Public Management and Budgeting Division; and

- Lorena Rivero del Paso, Public Financial Management Advisor at the International Monetary Fund (IMF).

All speakers agreed that in an environment where there are accounting and auditing skills shortages in all sectors of the economy, the public sector particularly needs to work hard to attract, develop and retain these skills. They also highlighted the need to work together for success, emphasizing that professionalizing public sector finance functions cannot be done in silos. A holistic and integrated approach is needed to bring all actors together.

Professionalizing public sector finance functions and building capacity and capabilities

For Ed Olowo-Okere, “the risks for public sector organisations that do not prioritise professionalising their finance functions have materialized already, in terms of poor management of funds, leakages of funds, and weak PFM performance, and things will only get worse in the current context." (see the PEFA Global Report on PFM)

For Tracey Carroll, “the priority to get started on a professionalisation journey is to identify what your key focus will be – it isn’t possible to fix everything at once.”

“Public service entities could also be better at promoting themselves to potential candidates so [those candidates] consider, and understand the value proposition of, a career in the public sector. It is also important to minimise competing against each other within the public sector,” she added.

Ed Olowo-Okere pointed out that for the profession the priority should be focusing on “advocacy to governments and donors, enlightenment of members, and adjustments to professional certification offerings to better cater for the public sector.”

For Lorena Rivero del Paso, “Investing in public finance professionals should not be seen as competing with other priorities: these professionals are necessary to make sure that public funds are well spent on pensions, healthcare, education, and more. Investing in public finance professionals should be seen as complementary to spending on other government priorities- not a zero-sum game.”

This was echoed by all. Tracey Carroll stressed that, “if we fail to demonstrate that we have strong financial management, it leads to distrust in government. So it’s a go-to for governments to ensure that the public service has the appropriate financial management skills within its workforce.”

Ed Olowo-Okere also argued that“If governments assign economists and historians to clinics to be treating patients, they should expect health outcome to be increasingly worse. Similarly, if they continue not to use professionals to manage their finances, they should expect increasingly worse public finance performance."

Attracting, recruiting and retaining the best talents to achieve successful professionalisation

All speakers agreed that when talking about the professionalisation of functions and upskilling, they're not just talking about narrow professional specializations. They are also looking at how public servants deploy those skills and use them in practice. It’s important to look at the strategic elements of the finance function, and how to manage public finance differently and better. It was highlighted that professionalizing the finance function also requires opportunities for continuous professional development, not just initial training and upskilling.

Alex Metcalfe shared key public sector-related highlights from ACCA’s Global Talent Trends 2023 report. “The findings show a sector in transition, facing many short-term challenges as well as big long-term questions, all set against the backdrop of societies still recovering from Covid and dealing with a challenging economic outlook,” he explained.

“But the report also sets out the advantages of a finance career in the public sector, which include for example: diversity of roles; working for the public good; balancing the interests of a wide range of stakeholders and contributing to addressing sustainability and climate change issues; working in a dynamic environment; being able to work for diverse organisations; and importantly, building trust and accountability,” Alex Metcalfe added.

Dónal Mulligan said that “governments around the world are focusing on the attractiveness of the public service. In a changing context, with increasing complexity, new skills and skill mixes are needed. But key questions are how these needs are communicated, how recruitment systems are set up to deliver, and what on-boarding and career development look like.”

“Attracting and retaining [talent] begins with quantifying and identifying the nature of skills shortages. But it’s important to go beyond numbers. The second step is identifying what candidates want. While generational differences are hard to measure, the good news is that governments offer many things that job-seekers say they want: value, impact, variety, growth, good leadership,” he explained.

For Lorena Rivero del Paso, “where there is evidence of difficulties in attracting and retaining staff, compensation increases may be part of the solution, but they should be carefully calibrated. Compensation in the government sector should be competitive with the private sector, but this does not mean that government employees should receive the same monetary compensation as in the private sector. Government employment typically offers higher non-monetary benefits - such as greater job and income security, more predictable working hours, better pensions, appropriate work/life balance, etc.--which should not be underestimated. Greater transparency in compensation can also help to allocate highly skilled professionals more efficiently across government functions.”

For Ed Olowo-Okere, a successful attraction and retention strategy would require four actions: “A clear vision on professionalisation; changing the rules so only professionals are in charge of managing finances; providing clear career paths for professionals; and better advocating the Public Sector employment value propositions.”

Tracey Carroll concurred with this last point, adding, “It's really important that we better explain what the employee value proposition is- there is so much that can be gained from a career in public sector, with the real sense of purpose of being able to make a contribution to the society.”

Boosting PFM Reforms Around the World | Full Webinar - July 13 2023

HIghlights from "Boosting PFM Reforms Around the World"

Useful resources

IFAC/ACCA

IFAC

- IFAC’s Point of View: Greater Transparency and Accountability in the Public Sector

- Broadening the Accountancy Profession’s Reach in the Public Sector

- Enabling an Effective Public Sector Finance Workforce | IFAC

- PFM Trends and Actions for the Accountancy Profession | IFAC

ACCA

OECD

- Financial Management in Government: Insights on Skills Development

- Public Employment and Management 2021 : The Future of the Public Service - Special focus: Recruitment in the public sector