In 2019, IFAC expanded its membership to include four new jurisdictions: Ecuador, Laos, Mozambique, and Suriname. The Ordem dos Contabilistas e Auditores de Moçambique (OCAM), the accountancy profession regulator in Mozambique and a professional accountancy organization, successfully became an IFAC Associate.

OCAM invested a great deal of time, energy, and resources to be fully prepared to submit a successful IFAC membership application.

After the IFAC Council meeting in November 2019, I spoke with Professor Mario Sitoe, President of OCAM, about OCAM’s journey as inspiration and guidance for future IFAC members.

Sarah Gagnon: How did OCAM’s journey to joining IFAC start?

Mario Sitoe: In 2016, we approached IFAC with an action plan that we thought was sufficient and demonstrated how we would fulfill IFAC’s requirements. We quickly learned it was not robust enough, as evidenced by IFAC’s first assessment and status report. Although IFAC recognized OCAM’s ambitions and willingness to improve, OCAM had much to do to fully meet the IFAC membership obligations.

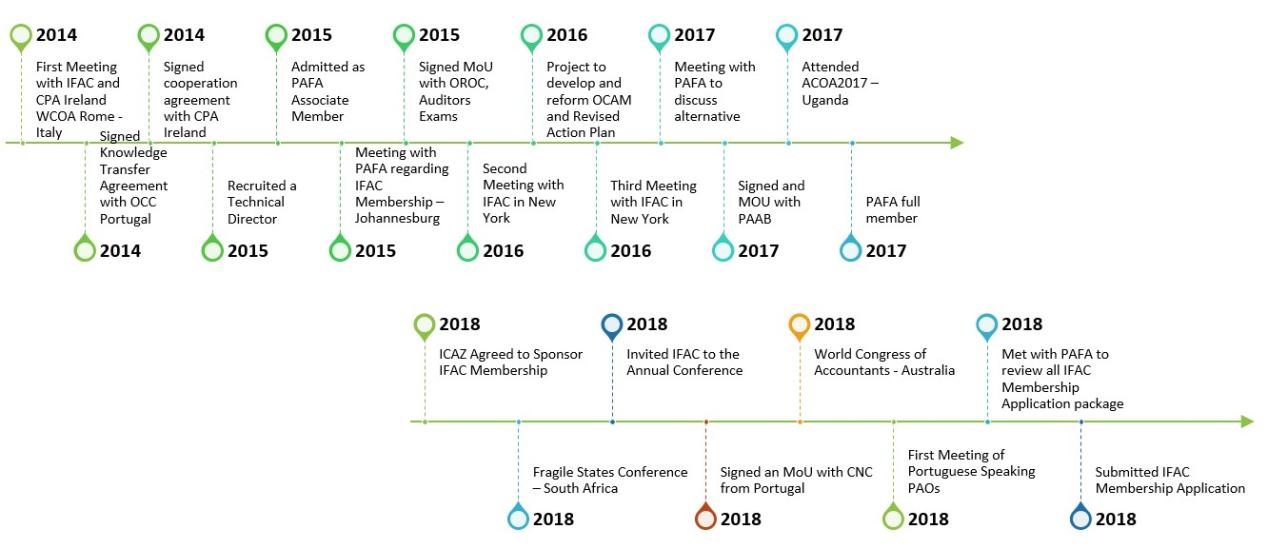

I admit it was disappointing news to receive. However, IFAC provided several suggestions for clarification and improvements and the strong recommendation that we work closely with the Pan African Federation of Accountants (PAFA) and a partner organization in the region that could provide guidance and later serve as our sponsor in the application process. After this, all our work with IFAC included a PAFA representative.

Image

SG: How did OCAM strategize to address IFAC’s recommendations?

MS: We discussed the recommendations with several donors who were keen to see OCAM advance and join IFAC. A strong OCAM would mean that donors and investors could better trust that their funding was properly accounted for. IFAC membership would also strengthen OCAM’s credibility with government and other stakeholders.

We agreed that we needed a well-developed PAO that could analyze our action plan and make recommendations. CPA Ireland generously agreed to help us and helped us draft a strategic plan: A Project to develop and reform Ordem dos Contabilistas e Auditores de Moçambique. This became our “holy grail” and included a plan to enable OCAM to meet IFAC obligations and become a sustainable PAO—including an indicative budget and proposed implementation schedule—that benefits Mozambique in the long term.

SG: What key areas did OCAM decide to work on first?

MS: Each IFAC requirement needed strengthening given the initial assessment and so we tackled them one-by-one. I can give you a few examples:

- We attended PAFA’s Quality Assurance (QA) workshop in Nairobi, which helped us realize we did not yet have technical capacity to carry out QA reviews even though it is included in our governing regulation. With PAFA’s support, we reached out to the Public Accountants and Auditors Board (PAAB) of Zimbabwe and signed a Memorandum of Understanding for a twinning partnership. With this partnership, PAAB conducts inspections on behalf of OCAM, whilst transferring skills to OCAM staff. The PAAB also offered to generously do so at no cost for OCAM, and we remain grateful for the support.

- To drive education forward, since it is the foundation of the accountancy profession our members and students need to demonstrate competencies, we signed Memoranda of Understanding with Ordem dos Contabilistas Certificados (OCC-Portugal) and Ordem dos Revisores Oficiais de Contas (OROC-Portugal) to implement examinations for accountants and auditors that we know met the International Education Standards (IES). We also partnered with companies and universities to utilize virtual software that simulates running a business from start to finish. This has helped give students a foundational understanding of workplace demands. Additionally, OCAM works with the Ministry of Education’s Council of Higher Studies (CNAQ) to design a national accounting curriculum that meets IES benchmarks. An OCAM and CNAQ team visit universities for accreditation purposes and provide recommendations to enhance training materials.

- To develop OCAM’s investigation and discipline (I&D) system—essential for maintaining public trust—we met with the Investigations Director of the South Africa Independent Regulatory Board for Auditors to understand their I&D procedures. We subsequently revised our regulations and hired a legal advisor to support our processes and act as our non-accountant representative. We now issue an annual report and major findings are published on our website as part of OCAM’s commitment to transparency.

SG: How did OCAM engage with stakeholders and ensure technical and financial support and buy-in for its initiatives?

MS: The strategic plan I mentioned earlier was key to donor and stakeholder engagement because it demonstrated that we were well prepared and understood what we needed and the estimated cost. We also invested time familiarizing ourselves with donors’ interest and could explain how supporting OCAM advanced their objectives, too.

For example, we received financial support from the Fundação para a Melhoria do Ambiente de Negócios (FAN—the Foundation for Improving the Business Environment) to train a committee on the technical standard-setting process to adopt the latest IFRS. This committee included representatives from the Mozambican Chamber of Commerce, Securities Exchange Commission, Bank of Mozambique, and Ministry of Finance, which will regularly meet in the future to adopt up-to-date standards.

SG: What sort of support did OCAM receive from PAFA?

MS: PAFA has been a key partner for us throughout the journey. After our first meeting with IFAC, there was not one step we took without consulting with PAFA. PAFA provided OCAM with a detailed explanation on the proper development of an action plan and supported us in finding the right partners. PAFA’s workshops are free for members and provide lots of information on what it means to comply with IFAC requirements.

PAFA also helped facilitate a connection between OCAM and the Institute of Chartered Accountants Zimbabwe (ICAZ)—which ultimately led to ICAZ sponsoring OCAM’s membership application. As sponsorship by an IFAC member is necessary in the IFAC application process, this was a crucial relationship to establish. Lastly, PAFA reviewed all our application materials to ensure they were properly completed.

SG: What are three key lessons that OCAM learned throughout the process?

MS: As a leader and as an institute, there were several things learned from the application process. My top three are:

- We learned it was very important to participate in PAFA and IFAC events. These events provide the opportunity to learn from other regional and international leaders and bring back ideas for OCAM to consider.

- It is critical to find the right partners for each of IFAC’s requirements. OCAM has worked with ICAZ, OROC, OCC, and the South African Institute of Chartered Accountants but in varying capacities—each one best suited to guide OCAM in a particular area.

- We realized that proper fulfillment of IFAC’s requirements, including adopting and implementing international standards, can be costly. PAOs must have a sensible financial plan that allows them to pursue the necessary improvements.

SG: What advice would OCAM give to other PAO’s interested in pursuing IFAC membership?

MS: I would remind them of the African proverb: “If you want to go fast, go alone. If you want to go far, GO TOGETHER.” There is great power in collaboration. I am proud of OCAM’s advances in the past view years to better serve the Mozambique citizens and economy. This is demonstrated in IFAC’s 2019 organization and country profiles. OCAM will only continue grow from here and we are happy serve as a support to other PAOs, especially in the African continent, who seek IFAC membership.

Image