The gap between the perception and the reality of what finance and accounting professionals do is widening. Perceptions can often focus on traditional accounting tasks, many of which are susceptible to automation. But careers in accountancy are evolving, and with shifting demands on the finance function, the nature of work undertaken by finance and accounting professionals is changing. Accountants are having to re-invent themselves to be more ‘marketable’ in future and to better fulfill business and commercial facing roles.

There is a shortage of accounting and finance professionals with the right blend of technical, business and soft skills. That was one of the messages from Fiona Wilson, Managing Director and Headhunter at FJWilson Talent Services, who joined the virtual Professional Accountants in Business (PAIB) Committee meeting to share both global recruitment trends at the executive level, as well as specific trends for accounting and finance professionals.

The PAIB Committee also heard perspectives from Ritu Kochhar, global partner for Spencer Stuart based in Mumbai, who focuses on board director recruitment, CEO and CFO searches. Ritu shared insights on hiring trends for CFOs/finance leaders, as well as finance organization trends in an Asian context.

Recruitment trends

Based on a review of various global and country specific research reports, surveys and other references, Fiona Wilson, summarized key global recruitment trends:

- Executive talent shortages are expected to persist in the context of uncertain economic and political outlooks, paired with international mobility and talent migration issues. Skills shortages exist globally across all sectors, particularly around digital transformation, leadership and management.

- For accounting and finance specifically, there are chronic shortages of professionals with the right blend of technical, business and soft skills. The nature of shortages varies from country to country as political and economic drivers influence demand for particular specialisms (e.g. compliance or tax).

- There is an increase in blended workforces of employees and contract workers. This is both a response to recruitment difficulties and an uncertain business environment, which will likely continue given the current COVID-19 situation.

- Talent pipeline issues exist for organizations, both in terms of new entrants to the profession, as well as competition across all career stages.

- What candidates want from employers varies as a result of having five generations in the workplace. Investment in employer branding is increasing in order to attract candidates. Factors that drive accounting and finance professionals to move jobs include career development, organizational culture and values, salary uplifts, and work-life balance flexibility.

- AI is increasingly being used in recruitment, but is most effective when combined with the ‘human touch’. For example, talent companies often find accounting and finance candidates that algorithms miss, with particular technical skills and potential to learn in any areas where they didn’t quite meet certain criteria.

From her experiences in recruiting across the Asia Pacific market, Ritu Kochhar shared trends in finance functions from an Asian context. These include:

- As the world is more connected than ever before, “glocal” CFOs are needed, those with knowledge of the local context (e.g. local taxation, and the way business operates in the region), combined with a global mindset and the ability to be culturally agile and relevant.

- Many new businesses in Asia are being set up by young entrepreneurs and backed by private investors, meaning a strong hands-on orientation and an entrepreneurial mindset is important for finance and accounting professionals working in these often small-and-medium sized entities (SMEs).

- Finance functions have a seat at the table as a strategic business partner to the CEO.

- A focus on cyber security and data protection with a raised profile for internal audit.

- AI and other technology and data capabilities are becoming increasingly important.

- Increased focus on diversity and inclusion in recruitment and the workforce.

- Embracing the needs of the biggest segment of the workforce: millennials, who will be the leaders of tomorrow.

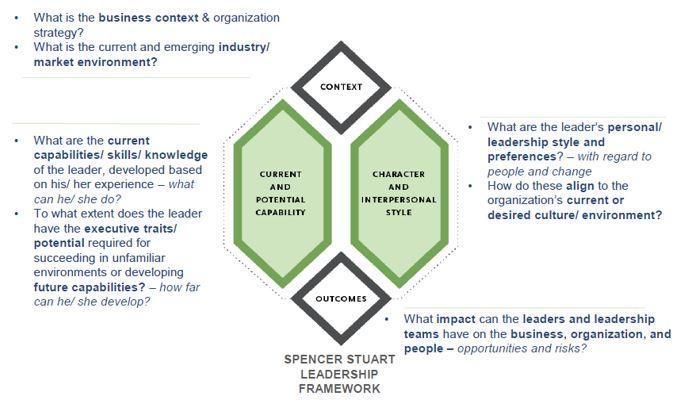

Ritu also discussed important factors to consider in hiring for CFO positions. Employers look for a combination of competencies and experiences. These will ultimately be determined by the requirements of a specific situation. As a guide for executive recruitment, Spencer Stuart has created a leadership framework with 4 key areas to consider:

Sought-after skills and capabilities

Skills required by employers are evolving in a rapidly changing world. Desired skills are a moving target and, therefore, there is a need for continual learning.

Fiona emphasized a high demand for skills to enable broader value creation (i.e. to be partners or advisors in business transformation), including:

- Higher level cognitive skills - complex problem solving; critical thinking; cognitive flexibility; strategic thinking; innovative thinking; evaluation and decision making

- Skills for collaboration and relationship building - emotional intelligence; service orientation; negotiation; communication

- Digital and data skills such as data analysis, data management, and digital security.

Spencer Stuart research has identified 6 capabilities that account for 85% of any executive role: Driving results; strategic thinking; collaborating and influencing; leading people; leading change; and developing organization capabilities.

Ritu also highlighted that candidates can have the best knowledge and skills, with strong strategic capabilities, but key to the long term success for any CFO in any environment is cultural alignment.

Key implications for professional learning and development:

- Accounting and finance professionals need a learning mindset and ability to gain new capabilities quickly with timely identification of training needs and self-curated learning. This applies across all career stages.

- Accounting degrees and initial professional development need to deliver smarter thinking skills as opposed to memorization of rules and practice. There is also a need to integrate more in-depth IT and analytics into learning.

- There is a proliferation of choice for continuing professional development (CPD), and PAOs need to help individuals navigate their options, for example through competency and career frameworks. There is also a need to encourage or incentivize development of much needed skills.

- In addition to formal education, informal learning opportunities are also important, including mentoring and coaching. With 5 generations in the workplace, there are more opportunities to learn from others’ experiences.

- Employers need to consider how they are creating a learning culture. Spencer Stuart set out 7 key actions to support growth and professional development:

- Give recognition and rewards

- Provide feedback in real-time

- Implement cross-departmental training programs

- Encourage mentoring and coaching

- Identify and develop soft skills

- Effectively use online resources and tools

- Take onus and look for self-development opportunities.

CFO Route to the Top

Spencer Stuart undertook an analysis of the background and experience of CFOs at top listed companies around the world in 2019. Findings include:

Previous CFO experience

Internal vs external hires

Tenure

Gender

Age

Nationality

Spencer Stuart undertook an analysis of the background and experience of CFOs at top listed companies around the world in 2019. Findings include:

Previous CFO experience

- Most likely to have previous CFO experience in Colombia (65%), Switzerland (60%), Belgium (58%), Denmark (55%), the Netherlands (52%), and the UK (51%).

- Least likely to have previous CFO experience in Mexico (7%), Peru (12%), and Argentina (22%)

Internal vs external hires

- Most likely to hire externally in Denmark (70%), US (61%), Netherlands (60%), UK (59%), and Belgium (58%)

- Most likely to hire internally in Spain (74%), Mexico (72%), France (71%), Chile (69%), South Africa (67.5%), and Peru (65%)

Tenure

- Average CFO tenure ranges from 3.9 years in Sweden to 7.7 years in Chile

- The longest tenured CFO was in the US (35 years), followed by the UK (28.2 years)

Gender

- Singapore ranked best for gender diversity, with 39% female CFOs, followed by Peru with 24%.

- There is still much to be done in terms of diversity in finance function leadership, and the onus is on board and CEOs to drive a diversity agenda.

Age

- The average age of CFOs ranges from 55 in Switzerland to 45 in Russia.

- The average age at appointment is between 40 – 49 in every country.

- The youngest CFO (30) and the oldest CFO (75) are both in the US

Nationality

- The majority of countries covered are more likely to hire local CFOs, including many Latin American countries, the US, Russia, Spain, Italy, Norway, Finland and South Africa.

- Switzerland (70%), the Netherlands (68%) and Belgium (53%) had the highest percentage of foreign CFOs