Bikash Prasad, President & Group CFO of Olam Agri participated in and presented at IFAC’s Professional Accountants in Business Advisory Group meeting in March 2023 to highlight his journey in transitioning to a Chief Value Officer (CVO) mindset and the implications on the role of finance and accounting professionals in Olam’s finance function.

Key messages:

-

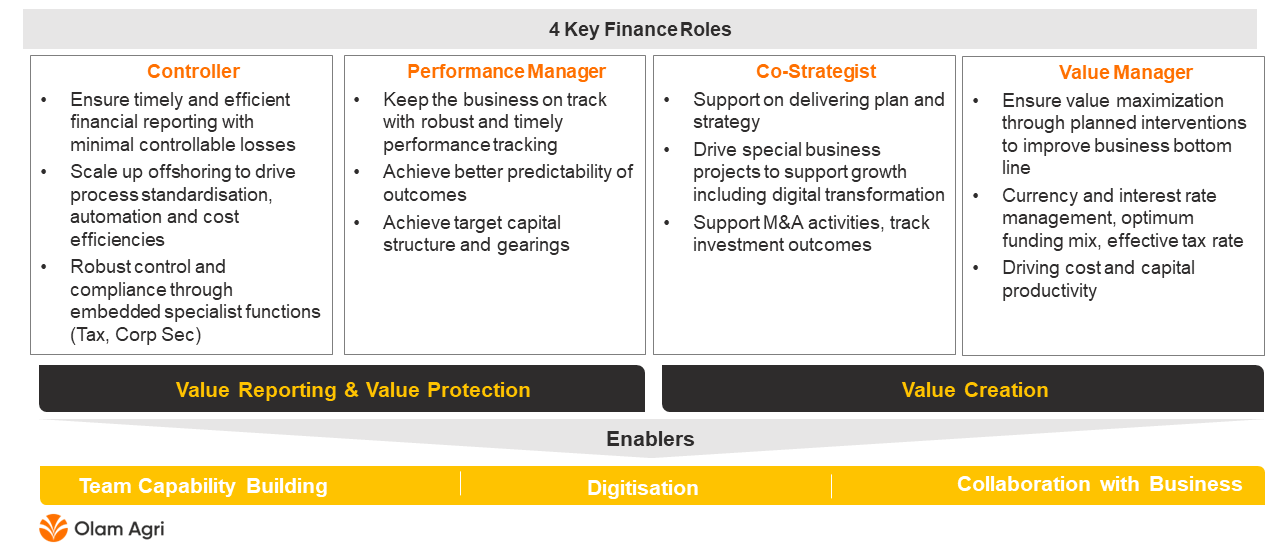

The finance function’s journey towards becoming a world-class business partner was hinged on four key finance roles: controller, performance manager, co-strategist and value manager. Together these roles provide a shared vision across the finance function in all locations to enable delivery of Olam’s business strategy and plan.

-

The need for championing an integrated mindset is the foundation for succeeding as a CVO. It is a critical success factor in delivering a comprehensive multi-capital approach to planning, decision making, measurement and reporting, and involves breaking down siloes and enabling organizational interconnectivity.

-

CFO and finance function transformation in Olam is founded on infusing value ownership into the organizational culture, adopting multi-capital accounting and reporting, business partnering, embedding sustainability and integrated reporting.

-

Olam’s finance function governance structure and talent management approach strengthens the finance team by:

-

Building strong senior leadership for today and the future.

-

Enabling the key capabilities, behaviors, and incentives to effectively partner and collaborate with other central functions.

-

Enabling sustainability and digital transformation within the business.

-

-

Olam’s organizational change and finance function transformation highlights opportunities for inspirational finance and business careers, as well as the organizational demands on professional accountants to contribute to long term strategic value creation and protection across all relevant capitals.

Olam Agri’s Approach to Responsible Business and Leadership

Olam Agri is leading the transition to support more people, produce more effectively, and farm more responsibly. Driving business resilience is based on building internationally recognized sustainability capabilities to unlock opportunities that build competitive advantage and outperform industry peers in pre-tax return on invested capital and return on equity. Key sustainability goals include:

-

Reducing greenhouse gas (GHG) emissions in operations and supply chain e.g., 16,000 Thai rice farmers cut emissions by 21% in 2021

-

Protecting Nature and Biodiversity e.g., through regenerative farming

-

Catalyzing livelihoods and sourcing responsibly e.g., providing 400,000 farmers with sustainability support

-

Future proofing supply base e.g., providing climate resilient seeds to 300,000 farmers

-

Enhancing Products e.g., producing 73 billion servings of fortified rice, flour, and oil

Olam’s Sustainability 2030 Targets connect to the Sustainable Development Goals:

The CFO and finance function roles have significantly evolved beyond the controllership and performance management responsibilities that are the cornerstone of the finance function’s traditional stewardship and value protection responsibilities. CFOs have been tasked with creating value by playing two additional roles as co-strategist and value manager.

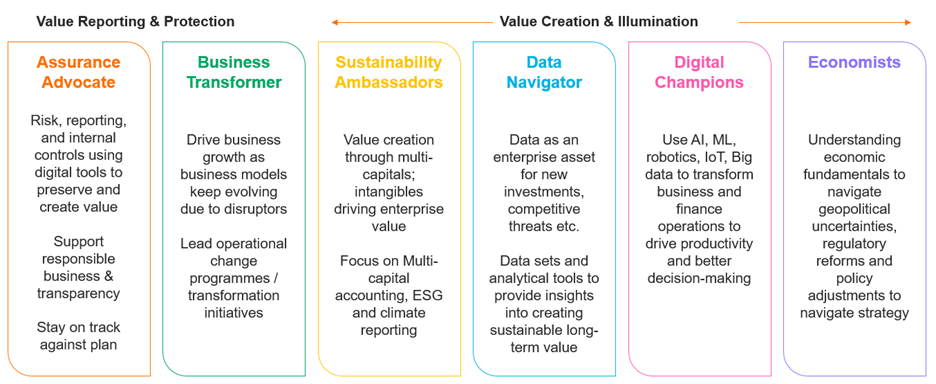

Continued disruption and uncertainty in the business environment requires a directional change of the CFO role to further elevate the value contribution of the finance function to help build the factory, farm and supply chain of the future. A re-imagination of the finance roles which provides a shared vision across Olam Agri’s approximately two-thousand finance and accounting professionals, fosters uniformity of understanding of the journey towards best-in-class business partnership by embedding value creation and illumination into each role across the finance function.

An Outward Perspective

The CFO and finance function needs to be outward focused by incorporating external trends, risk and opportunities into the finance roles – including embracing regulatory and accounting reforms, climate change and sustainability impacts, digital and supply chain disruption, geopolitical uncertainties and heightened protectionism, and inflation and monetary policy adjustments.

Achieving purpose and strategy involves a comprehensive understanding of the business and its environment, and how key market drivers match Olam’s differentiated business model and capabilities. For example, the growth in the global population and the middle class in emerging markets drives increasing demand for food, feed and fiber, and focus on food security. These drivers align with its expertise in emerging markets, building smallholder farmer capacity while eliminating unacceptable land use practices.

As uncertainty and volatility have become the norm, Olam Agri proactively responds to external factors such as supply challenges, increasing commodity prices and export bans in various countries. Dealing with sustainability impacts and leveraging related data as a business asset is not a choice but a necessity. For example, the finance function has played a role in leveraging big data and satellite imaging to enhance the use of fertilization and irrigation at the farm level which has reduced fertilization consumption by 30 percent.

Championing an integrated mindset is needed to succeed as a CVO

An integrated mindset is the critical success factor in delivering a comprehensive multi-capital approach to planning, measurement and reporting. An integrated mindset involves breaking down siloes and enabling organizational interconnectivity and incorporating relevant capitals into decision making.

Effective finance business partnership enables collaboration across functions, business units and regions and connecting the business model to all relevant capitals and value drivers.

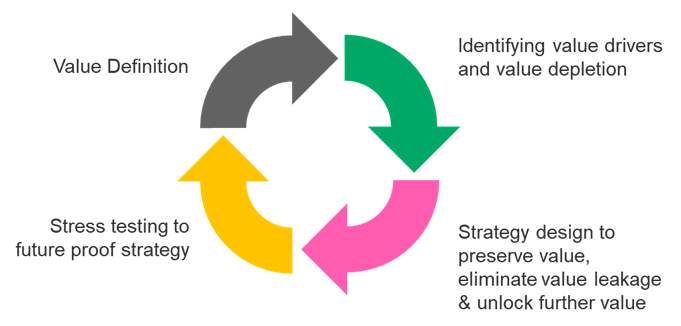

Organizational change within Olam Agri’s finance function is based on:

- Infusing value ownership into the organizational culture: based on a clear understanding and definition of value in relation to financial and other capitals, identifying value drivers and causes of value depletion, designing strategy to preserve value, eliminate value leakage and unlock further value, and stress testing to future proof strategy.

- Shifting from single (financial) to multi-capital accounting and reporting: by establishing multi-capital accounting methodologies focused on human, social and natural capital allowing externalities related to these capitals to be integrated into the economics of the business along with information relating to financial, manufactured, intellectual and intangible capitals. A center of excellence to embed capitals accounting has been established.

- Business partnering: Ensuring multi-disciplinary collaboration and influencing others across the organization and co-driving impact with other business partners. Sustainable outcomes require extensive collaboration and coordination to translate group targets into business unit and country initiatives, agree on the right KPIs to measure the impact of sustainability initiatives and performance, and leverage technology to innovate. Incorporating relevant sustainability metrics into decision-making and change culture from “what is the cost” to “at what cost”

- Embedding sustainability into the organization’s DNA: requires linking senior business leadership incentives to sustainability goals, incorporating impact information into investment appraisals, allocating carbon budgets and using internal carbon prices to influence decisions, and optimizing and automating processes and data collection to enhance data integrity.

- Integrated Reporting: Incorporating climate and sustainability information into external reporting and developing a range of transition and physical risk scenarios and assessing implications at an income statement and balance sheet level.

|

Key Benefits of Multi-Capital Accounting

|

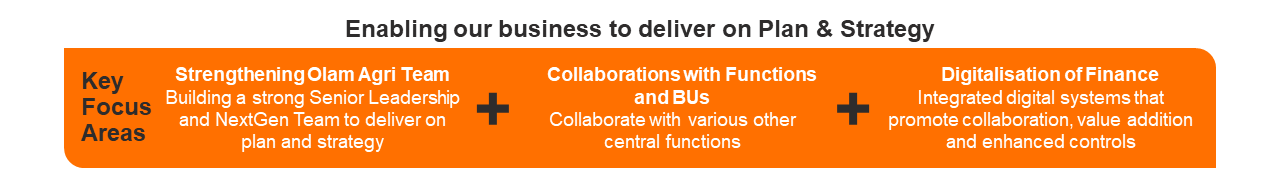

A finance function structure and talent management to create, protect and generate value

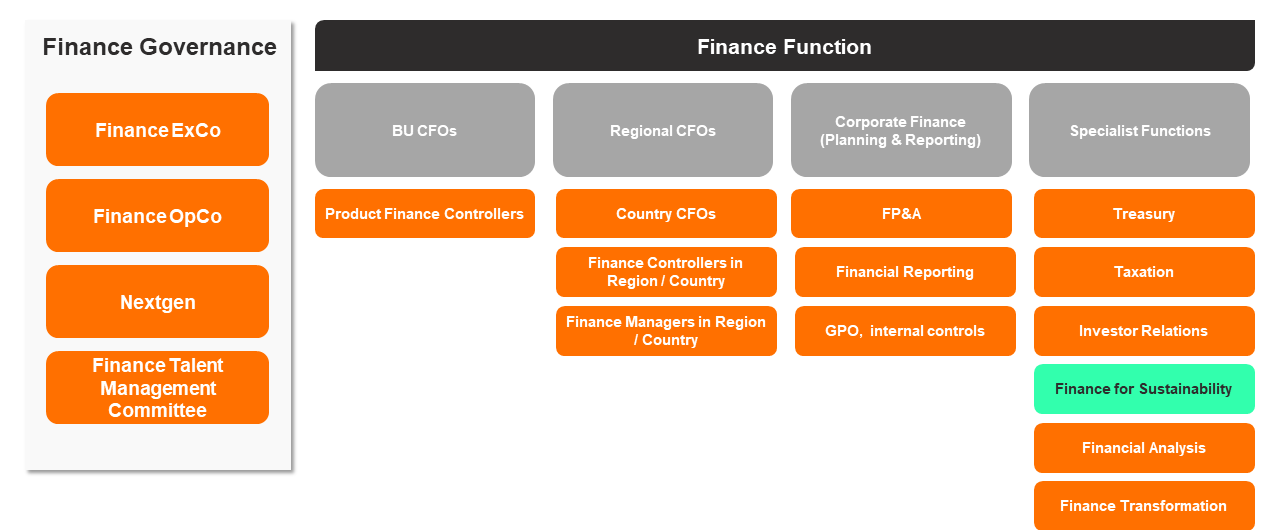

Olam Agri’s finance function is organized into four streams covering commercially facing business unit CFOs, regional CFOs who provide country perspectives, corporate finance, and specialist functions including finance transformation and finance for sustainability. The work of the Finance for Sustainability team is explored in the case study on The Role of the Sustainability Finance Team in Driving Impact at Olam Agri.

An overarching four-level finance function governance structure provides governance, direction and shared learning across all finance function activities:

- Finance Executive Committee engages with business teams to establish the right culture across the finance function for effective collaboration and business partnering

- Finance Operations Committee focuses on systems and processes to improve delivery of finance activities and processes including integrated digital systems that promote collaboration, value addition and enhanced controls

- Nextgen is a pipeline of the next generation finance leaders who have the opportunity to be mentored by the organization’s senior leadership; nurturing a finance team of the future

- Financial Talent Management Committee including participation from human resources to consider capability needs and relevant professional learning and development, promotions and transfers.

Olam adopts an employee lifecycle strategy to develop inspirational finance leaders and attract top talent to drive productivity covering:

- Attraction: Raising employer brand awareness of Olam as a ‘great place to work’ with a strong company culture, and competitive in terms of attractive compensation and benefits

- Recruitment: Aligning individual personas, values and talents with the Olam values and culture, adopting various recruitment avenues, and being clear on the requirements for different finance roles

- Onboarding: Implementing an impactful and detailed onboarding program that includes a buddy program, a network of introductory engagements with leaders and peers, and clarity of role expectations

- Development: Providing high-powered development programs, inspirational leadership and encouraging aspirational behaviors. Development includes career conversations aligned to success profiles for different roles, enabling finance employees to prepare for new roles

- Retention: Through cultivation of relationships based on values (openness, honesty and respect) alignment on Olam’s mission and team aspirations, engagement surveys, and understanding of team and individual needs.

The lifecycle model is supplemented with a 6Cs Finance Engagement Model that is deployed across the entire finance function in all locations.

A recent initiative, Project Ascent, allows finance staff to undertake cross-country visits to foster cross-pollination of learnings across locations. In addition to providing the opportunity for the finance team to enhance their knowledge and understanding of various businesses, finance team members from other locations review the financial performance of other businesses within the group to provide additional assurance and to share best practices.

Olam’s talent management has led to an inspired team with high finance employee engagement scores. The 6Cs engagement model is now being deployed in other functional areas.

The transformation to CVO is leading to a significant mindset change among finance and accounting professionals about their contribution to business transformation and value creation, protection and reporting to deliver a resilient and sustainable business model.

Explore additional resources from the Professional Accountants as Business Leaders and Value Partners Content Series.