Available Languages:

- English

- | Spanish

ESG reporting has become essential for companies and investors to make decisions that promote a sustainable future. To gain insight into the state of global disclosure and assurance of ESG information, the International Federation of Accountants (IFAC) developed the State of Play in Sustainability Assurance, a benchmarking study that captures and analyzes the extent to which companies are reporting and obtaining assurance over their sustainability disclosures, which assurance standards are being used, and which companies are providing the assurance services, with a methodology to analyze non-financial information published by companies listed on stock exchange markets across 22 jurisdictions.

In Mexico, IFAC's study focused on the 50 largest companies. To have a full picture of our local situation, the Academic Department of Accounting of the Instituto Tecnológico Autónomo de México (ITAM) decided to expand the study. We wanted to gain a more comprehensive understanding of the current state of ESG corporate reporting in Mexico and to determine if Mexican companies are prepared for the implementation of the standards proposed by the International Sustainability Standards Board (ISSB). Our research sought to expand the sample and analyze the 148 companies listed on the Mexican Stock Exchange (BMV) and the Institutional Stock Exchange (BIVA). Data collection followed the methodology proposed by IFAC and took place in January 2022. The reports reviewed are from 2020.

The most significant results of the study are presented below.

Image

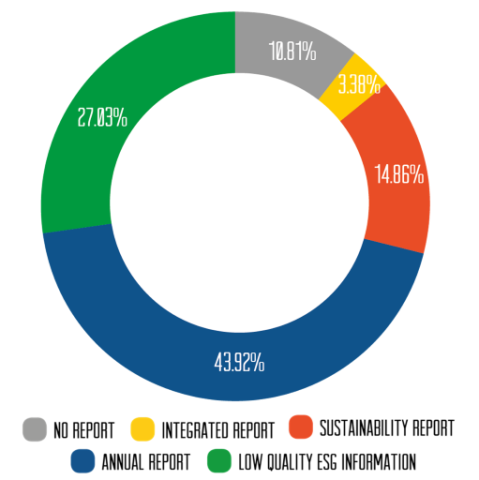

Graph 1. The 62.16% of the companies studied in Mexico publish high-quality ESG information.

In Mexico, 62.16% of the studied companies provide quality ESG information through annual reports, sustainability reports, or integrated reports. However, only 34.07% of them included an independent assurance opinion. Increasing this figure will improve the credibility of the ESG information released by companies. In comparison, IFAC's findings showed that 78% of Mexico's 50 largest companies disclosed ESG information, with 49% offering assurance.

- The difference between the two studies can be attributed to the larger sample size; many of the companies not included in the IFAC study only trade on the Mexican stock exchanges. As a result, they face less pressure to provide high-quality ESG information.

- Additionally, the Mexican Stock Exchange requires companies to disclose certain ESG information in their annual report. This information is divided into three sections: Environmental Performance, Human Resources and Administration. However, it is not mandatory for companies to align this information with any non-financial information reporting framework. As a result, some companies limit their reporting to compliance with environmental regulations, a description of their workforce, and a list of members of their corporate governance body. Moreover, in most cases, this type of ESG information lacks metrics to measure the scope of the company's actions on ESG issues and does not include its objectives to improve its performance in these areas. Therefore, companies that only published ESG information through the BMV's annual reports were classified as having low-quality information; 27.03% of the companies studied received this classification.

We also decided to expand the analysis that IFAC performed to understand what was happening in ESG reports by sector.

Image

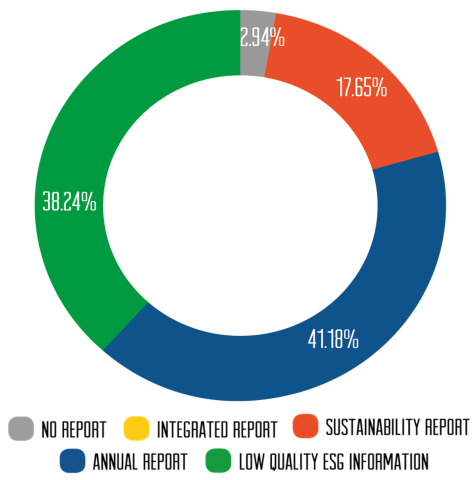

Graph 2. The industrial sector is one of the most polluting sectors in Mexico, however, only 58.82% publish high-quality ESG information.

- After conducting a sectoral analysis, it was identified that only 58.82% of companies in the industrial sector publish quality ESG information, of which only 20% provide some type of assurance. This sector is one of the largest and most polluting in Mexico, so it is essential that these corporations intensify and make transparent their actions to reduce their environmental impact.

Image

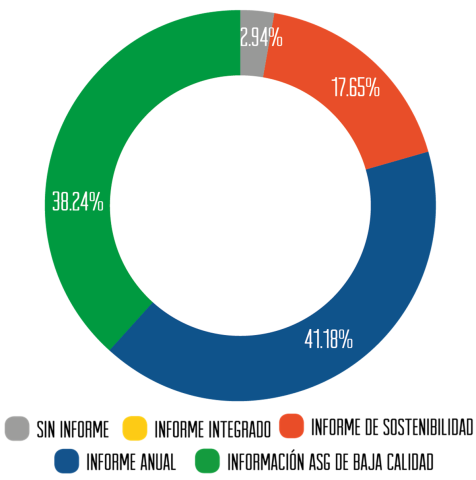

Graph 3. The 58.83% of the companies that belong to the Mexican financial services sector publish high-quality ESG information.

- Similarly, companies that belong to the financial services, health, non-basic consumer goods, and telecommunications sectors need to increase their disclosure of ESG information, as it is relatively low compared to other sectors. Particularly, companies in the financial services sector should take steps to measure scope 1, 2, and 3 emissions – the latter being especially important to measure the environmental impact of the projects they finance.

One of the biggest challenges in ESG disclosure is the lack of consensus on frameworks and standards. This lack has hindered the implementation and comparability of ESG reporting.

Image

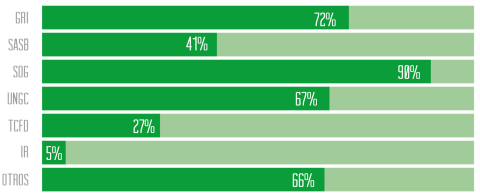

Graph 4. The GRI standards and the Sustainable Development Goals were the most referenced frameworks/standards by Mexican companies in their ESG corporate reports.

- In Mexico, 71.43% of companies that report ESG information use GRI standards. Additionally, 91.21% refer to the Sustainable Development Goals, despite not being considered a standard or framework for ESG reporting. These results align with the findings of the IFAC, as the GRI standards and the SDGs were also the most referenced frameworks/standards among the 50 largest companies in Mexico.

- Regarding the SASB standards, TCFD recommendations, and IIRC guidelines, they are used relatively less than others: 41.76%, 27.47%, and 5.49%, respectively. Therefore, it is essential that Mexican companies become familiar with these methodologies to make the transition to the ISSB standards smoother when they become mandatory.

In summary, there is an effort in the Mexican market to disclose ESG information. Nevertheless, it is key to increase the level of assurance and promote the use of the frameworks and regulations recommended by ISSB standards, such as IR, TCFD, and SASB. Furthermore, companies listed on the Mexican Stock Exchanges only represent a small fraction of the country's economic ecosystem, since most Mexican companies are classified as SMEs (small and medium-sized enterprises), making it difficult to obtain a complete picture of the state of disclosure of ESG information in Mexico. Therefore, it is important to create channels and tools to enable SMEs to generate and share this information with stakeholders.

To get access to the full report, please click here (the report is available only in Spanish).