Uniting for a Stronger Accountancy Profession: National PAOs Introduce a Joint Code of Ethics for Indonesian Accountants

The public sector is an essential part of every economy[1]. Governments spend large sums of public money on a range of services and infrastructure for their citizens. And in times of crisis, such as the 2008 global financial crisis, and more recently the COVID-19 global pandemic, governments increasingly use fiscal policy measures to support public social, infrastructure and health systems, and provide direct financial support to businesses and citizens through measures such as income support and unemployment benefits. Only governments are able to provide this kind of support at scale during these crises.

Globally, public sector entities face many challenges, which can include increased demand for high quality services, outdated infrastructure, tax competition[2], a low tax base, loss of trust[3], and the impact of changing demographics causing funding shortfalls for pension and social benefit schemes.[4]

As governments contend with competing priorities, they need to make important decisions with the aim that short-term measures are taken with appropriate regard to long-term financial sustainability and resilience. Decisions made by governments today will impact generations to come[5], and will have implications for future policy, tax, and spending decisions. The basic social contract between governments and citizens is continually changing, and therefore, there is heightened need for transparency and accountability to help citizens understand how public funds are being managed and spent[6], how decisions are made and why, and the evidence and information to support decisions.

To ensure governments and public sector entities around the world make informed decisions for people, the planet, and the economy, they need strong governance and public financial management (PFM). The accountancy profession—professional accountancy organizations (PAOs) and individuals—have an important role to play in supporting fit-for-purpose PFM and an effective public sector. Working together, the public sector and accountancy profession can help deliver a more sustainable, inclusive, and prosperous future.

To manage public resources effectively and efficiently, governments need strong governance and a robust PFM system so that the use of resources is tracked, and that resources are appropriately allocated against public policy objectives. Governments must endeavor to achieve the most with the resources they have, maximizing efficiencies in public service delivery, while minimizing loss through waste, fraud, or corruption. Governments face numerous competing priorities and require reliable financial and non-financial information to make informed, data-driven decisions on priority areas of spending and investment. To enhance governments’ accountability for decision making high levels of transparency are required

1. This document will use the IPSASB definition of public sector: Public sector entities include national, regional (for example, state, provincial, territorial) and local governments (for example, city, town) and their component entities (for example, departments, agencies, boards and commissions). It is not meant to refer to State-owned Enterprises (SoEs) or similar commercial entities.

2. Referring to countries using preferential tax rates as a competitive advantage, both “acceptable” tax competition and “harmful” tax competition

3. Edelman Trust Barometer 2021: Government was the most trusted institution in May 2020, then lost its lead 6 months later and is now less trusted than business and NGOs.

5. ICAEW/PwC: Intergenerational fairness “Today’s intergenerational policy challenge ranges from employment to social affairs and healthcare, from education and infrastructure to pensions. It encompasses financial as well as non-financial liabilities, e.g., in form of ‘environmental debt’ that we leave behind for future generations.”

6. An example approach - the Open Government Partnership (OGP) promotes and supports the importance of government transparency for citizens by ensuring that civil society organizations or direct citizen engagement has a role in shaping and overseeing governments.

9. Examples include CIPFA’s Whole Systems Approach, PEFA’s PFM Framework, and CAPA’s Eight Key Elements of PFM Success.

10. Public Finance Focus: Challenges to successful PFM reform

11. Successful implementation of these standards is a complex, resource-intense, multi-stakeholder endeavor requiring expertise and adequate infrastructure. To support best practices in Africa, PAFA has issued guidance on practical approaches: International Public Sector Accounting Standards (IPSAS) Implementation Road Map for Africa

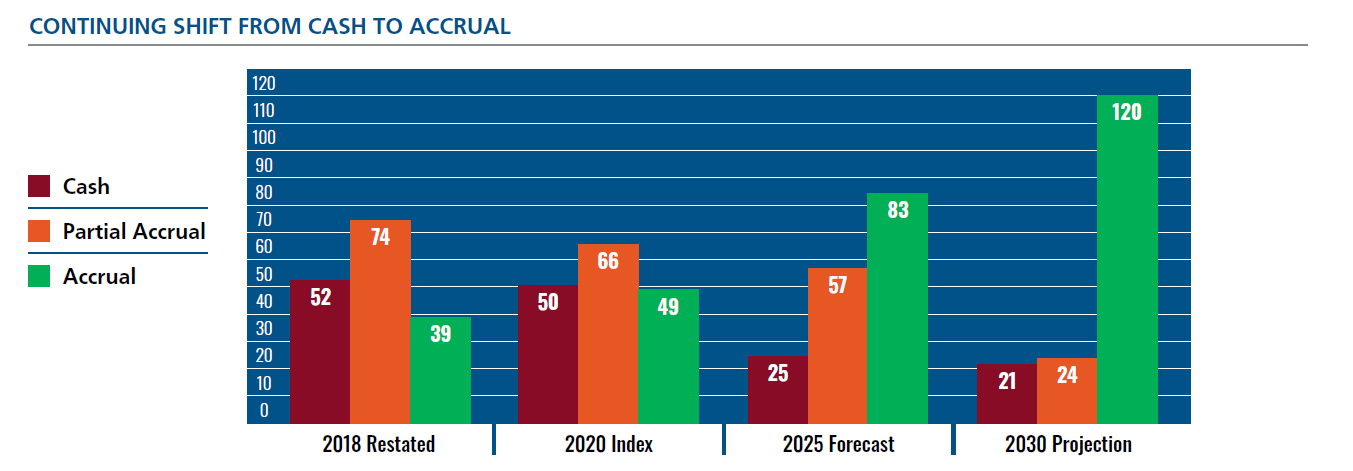

12. Although there has been positive momentum behind the global transition to accrual accounting, full implementation of IPSAS is still a longer-term endeavor for many governments. For those, we encourage the use of the COVID-19 Intervention Assessment Tool, as an immediate way of evaluating the financial impacts of current and planned policy initiatives. This tool can be used independently of where a jurisdiction is on the path to full accrual.

13. The B20 Integrity & Compliance Taskforce, for example, recently recognized this in its 2020 recommendations to the G20: The B20 also recognizes that there is a link between public procurement, public sector accounting and corruption, and that implementation of high-quality accrual accounting standards in the public sector leads to lower incidences of corruption. The B20, therefore, further calls on the G20 Members to lead the way in the global application of accrual accounting in the public sector and, in particular, the International Public Sector Accounting Standards.

15. IFAC/ACCA: Is Cash Still King? Subject matter experts interviewed for this research argued that there were advantages for governments in consistently applying an accrual basis through the entire PFM system. They strongly supported this approach for producing rich, decision-useful information for governments.

16. The consequences of corruption are significant and widespread, from direct costs to individuals and society, to encouraging criminal behavior and undermining trust in institutions. Grounded in a strong ethical code, professional accountants across the globe play a critical role in the fight against corruption: Fighting Corruption and Money Laundering | IFAC. See also IFAC/ICAEW series: Anti-Money Laundering: The Basics

17. The International Organization of Supreme Audit Institutions (INTOSAI) has developed a comprehensive set of professional pronouncements for SAIs along with a number of guides, tools and models that support the development of SAIs.

18. In developing the institutional capacity of SAIs (and, as a result, the capacity of individuals), a staff exchange program between SAIs, as well as between SAIs and private sector audit firms involved in public sector auditing, can be helpful as a means of building up skills of the SAI’s staff in respect of auditing accrual-based financial statements, and to provide a knowledge exchange between different auditors. Alternatively, subcontracting all or part of public sector audits to private sector audit firms can help to bring specialist skills to audits where those skills are not present in the public sector audit body. It can also ensure that public sector audit bodies maintain their audit methodologies in line with best practice in the private sector.

While frameworks and standards are crucial to strengthening PFM, having the right people, with suitable training and the right skills and competencies across governments and public sector entities, is fundamental. However, in many jurisdictions, there is a shortage of professional accountants in the public sector. Public sector leaders must understand and embrace the importance of the skills, ethics and public interest focus that the accountancy profession can bring. In serving the public interest, there is an incredibly important need for public sector leaders and the accountancy profession to work together in supporting professionalism in the public sector. Together, we can create a better world with stronger economies and fairer societies.

19. IFAC Point of View: Embracing a People-Centered Profession - Diversity of skills within firms, businesses, the public sector and PAOs is increasingly necessary as the demands of society and stakeholders evolve

20. Professionalization involves increasing the number and capacity of skilled and competent professionals, with suitable training and recognized qualifications, and ensuring strong professional and ethical standards.

21. CIPFA: Competencies are needed around areas such as public sector context and needs; technical skills; leading and influencing; and increasing public value

22. The INTOSAI Capacity Building Committee (CBC) recognizes that SAIs operating in complex and challenging contexts may have greater challenges than other SAIs in availing themselves of the tools, models and support available within the INTOSAI community or implementing existing standards and guidance.

24. IFAC/AAT An Illustrative Competency Framework for Accounting Technicians -The Framework’s illustrative example is a resource for PAOs creating an Accounting Technician designation as an additional pathway into the accountancy profession.

25. Example approaches are set out in CAPA’s publication, PAOs: Extending Activities into the Public Sector

26. The Public Policy and Governance Committee at ICPAK is such a committee. PAFA aims to assist its other PAOs members establish similar committees.

The United Nation’s Sustainable Development Goals (SDGs), in combination with national sustainable development plans, provide context to government policy and spending decisions to address systemic, interconnected issues such as climate, inequality, access to education, and poverty. But to date, efforts to achieve the SDGs have fallen short[27] and widening inequality between and within countries remains a huge challenge[28]. Governments have a significant contribution to make in delivering the SDGs, not only in their policy and operational roles, but through collaboration globally ensuring no country is left behind, and nationally with different sectors and stakeholders[29], including public-private sector partnerships.

Going forward, public sector accountability and trust will hinge on strong governance and transparent financial and non-financial reporting by governments and public sector entities. Enhancing transparency in public sector reporting will sustain the mandate on which public officials and institutions rely to operate on behalf of stakeholders (i.e., citizens), and underpin an informed debate about longer-term tax and spending. The pace and focus of reporting non-financial information will be driven by specific information demands from specific stakeholder groups. The combination of the urgent need for action to prevent further climate change, alongside the need for better information to support the difficult decisions that most governments face following the pandemic, may provide the catalyst for such reporting changes. The accountancy profession can play a critical role in implementing strong governance and PFM globally, drawing on the skills and ethics of individual professional accountants, we can effectively navigate to a prosperous, inclusive, and sustainable future for everyone.

31. IFAC: From Crisis to Recovery: Public Sector Priorities to Support COVID-19 Recovery - Taking healthcare as an example, it is important not to only deal with the current health emergency, but also tackle the underlying causes of poor health outcomes by focusing spending on areas that will address structural challenges. For example, consider increasing investment in preventative care to reduce future pressures on acute healthcare. Ultimately, this requires a holistic strategy that factors in other related areas such as social care, housing, and education, all of which have an impact on health outcomes.

33. In recent years, the private sector has increasingly recognized the urgent need for better sustainability and other non-financial information, and the IFRS Foundation and others are taking steps to enhance corporate reporting.

The IAASB in collaboration with IFAC invite you to join our upcoming quality management webinars, Resourcing for Quality Management on July 29 from 11 am–12 pm GMT and Your Firm’s Monitoring & Remediation Process on August 5 from 11 am–12 pm GMT. Both webinars will be held on Zoom with livestreaming on IAASB’s YouTube channel.

ISQM 1 is part of the IAASB’s suite of quality management standards, issued in late 2020. The standards strengthen and modernize how firms approach quality management. They also mark an evolution from a traditional, more linear approach for quality control to an integrated quality management approach. These webinars address how firms can resources appropriately and establish monitoring and remediation processes to align with the requirements in International Standard on Quality Management 1, Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or Other Assurance or Related Services Engagements.

The webinars will be held in English and available on YouTube following the session. Participants joining live via Zoom will be able to submit questions.

The recording from the first webinar in this series, Your Firm’s Risk Assessment Process, is available on YouTube. You are also invited to the final webinar in the series:

Looking for additional resources on the suite of quality management standards? Check out the IAASB’s dedicated web page: iaasb.org/quality-management

The IAASB in collaboration with IFAC invite you to join the upcoming quality management webinars, Resourcing for Quality Management on July 29 from 11 am–12 pm GMT and Your Firm’s Monitoring & Remediation Process on August 5 from 11 am–12 pm GMT. Both webinars will be held on Zoom with livestreaming on IAASB’s YouTube channel.

ISQM 1 is part of the IAASB’s suite of quality management standards, issued in late 2020. The standards strengthen and modernize how firms approach quality management. They also mark an evolution from a traditional, more linear approach for quality control to an integrated quality management approach. These webinars address how firms can resources appropriately and establish monitoring and remediation processes to align with the requirements in International Standard on Quality Management 1, Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or Other Assurance or Related Services Engagements.

The webinars will be held in English and available on YouTube following the session. Participants joining live via Zoom will be able to submit questions.

The recording from the first webinar in this series, Your Firm’s Risk Assessment Process, is available on YouTube. You are also invited to the final webinar in the series:

Looking for additional resources on the suite of quality management standards? Check out the IAASB’s dedicated web page: iaasb.org/quality-management

IFAC is committed to supporting our member organizations and the development, adoption, and implementation of high-quality international standards.

Company-reported information about sustainability factors is becoming mainstream—through increased voluntary disclosure as well as through new jurisdiction-specific rules. Investors, as well as other stakeholders, need to have trust and confidence in this information through external assurance—just like financial information.

Highlights from the CAG June 2021 virtual meeting:

00:00 Welcome and introduction

00:20 Chair’s summary of the IPSASB CAG meeting

06:14 Closing remarks

Highlights from the June 2021 virtual meeting:

00:00 Welcome and introduction

00:25 Adjustments to the Work Program

05:26 Revenue and Transfer Expenses

10:10 Natural Resources / Sustainability

19:00 Closing remarks

Global practices for sustainability assurance—including the prevalence of assurance, level of assurance, and standard and practitioner used—varies widely by jurisdiction, according to a new study from the International Federation of Accountants (IFAC) and the AICPA & CIMA (representing the Association of International Certified Professional Accountants). The new study is a groundbreaking review that provides a comprehensive global picture of the current status of assurance. The study further contextualizes this analysis with data on how and where sustainability-related information is reported, and how this relates to assurance practices.

As the drive toward a global system for sustainability-related reporting continues, investors, regulators and policymakers are turning their attention to the important role of assurance in promoting high-quality reporting. With the growing importance of—and reliance on—sustainability information, low-quality assurance is an emerging investor protection and financial stability risk.

“The global community needs to consider many complex questions—should reporting sustainability information be required? If so, should assurance be required, and by whom? With this new data in hand, IFAC is initiating evidence-based conversations with our member organizations and other global stakeholders to advance the global debate and help plot the way forward in the public interest,” said IFAC CEO Kevin Dancy. “We will continue our commitment to this space as the reporting and assurance landscape evolves.”

“Companies that publish sustainability information that is subject to assurance by professional accountants have an opportunity to bring trust and reliability to their sustainability information. Engaging a licensed professional accountant who possesses the right combination of professional skills, qualifications, experience and is subject to independence, ethical and monitoring requirements can result in truly meaningful assurance and transparency,” said Susan S. Coffey, CPA, CGMA, CEO of Public Accounting at the Association of International Certified Professional Accountants. “As it stands, only around half of the companies reviewed in this study publish sustainability information that is subject to any assurance.”

The full study is available on the IFAC website. For more information on AICPA & CIMA sustainability resources for the accountancy profession, please visit:

About the Study

IFAC and AICPA-CIMA partnered with Audit Analytics to understand the environmental, social, and governance (ESG) reporting and assurance practices on a global basis by capturing reports containing ESG information in 22 jurisdictions. 100 companies were reviewed from each of the largest six economies, with 50 companies reviewed in the remaining 16 jurisdictions. Full methodology is available in the study.

About IFAC

IFAC is the global organization for the accountancy profession dedicated to serving the public interest by strengthening the profession and contributing to the development of strong international economies. IFAC is comprised of 180 members and associates in 135 countries and jurisdictions, representing more than 3 million accountants in public practice, education, government service, industry, and commerce.

About the Association of International Certified Professional Accountants, and AICPA & CIMA

The Association of International Certified Professional Accountants® (the Association), representing AICPA® & CIMA®, advances the global accounting and finance profession through its work on behalf of 696,000 AICPA and CIMA members, students and engaged professionals in 192 countries and territories. Together, we are the worldwide leader on public and management accounting issues through advocacy, support for the CPA license and specialized credentials, professional education and thought leadership. We build trust by empowering our members and engaged professionals with the knowledge and opportunities to be leaders in broadening prosperity for a more inclusive, sustainable and resilient future.

IFAC, AICPA & CIMA Global Benchmarking Study Highlights Significant Differences Across Jurisdictions

This special event will include contributions from His Royal Highness The Prince of Wales who will open the event, sharing his thoughts on why the finance and accounting community has such an important role in tackling climate change.

During the event, A4S and CFOs from the COP26 Principal Partners will explore the role of the finance community in driving climate action in the run up to this year’s UN Climate Conference (COP26).

The IPSASB approved its Mid-Period Work Program Consultation. This consultation seeks constituent feedback on which projects the IPSASB should prioritize as its resources become available. The IPSASB will hold several regional virtual outreach events during the consultation period to directly engage with constituents.

The consultation is expected to be published in July 2021 with a 4-month comment period. Watch for the consultation for the full details on the IPSASB’s proposals.

The IPSASB approved Exposure Draft (ED) 80, Improvements to IPSAS, 2021, which includes both general improvements and IFRS related improvements to IPSAS. General improvements consist of proposals for minor amendments to IPSAS identified by stakeholders. IFRS related improvements consist of proposals for minor amendments to IPSAS sourced from recent IFRS improvements and narrow scope amendment projects.

ED 80 is expected to be published in July 2021 with a 60-day comment period.

The IPSASB reviewed the draft Consultation Paper (CP) and considered the general description of natural resources. The IPSASB discussions focused on the overall approach to determining the recognition, measurement, and disclosure of items which fit into this general description of natural resources, and those that do not, as well as how the description relates to the specific topics included in the CP. The IPSASB also discussed the description, recognition, measurement, and disclosure of water.

The IPSASB continued its discussions on Revenue and Transfer Expenses topics identified during its review of responses to the Exposure Drafts. Based on discussions, the IPSASB decided to retain the current definition of a binding arrangement, with minor revisions, and clarified specific considerations when assessing enforceability of a binding arrangement. The IPSASB also discussed the definition of a liability in the context of the ongoing projects.

The IPSASB approved IPSAS 5, Borrowing Costs – Non-Authoritative Guidance, which reaffirms the IPSASB’s decision to maintain the accounting policy choice to capitalize or expense borrowing costs directly attributable to a qualifying asset. The non-authoritative guidance added includes implementation guidance and illustrative examples to clarify how to determine the extent to which borrowing costs can be capitalized.

The main issues discussed related to prudence and materiality. The IPSASB decided not to adopt prudence as a separate qualitative characteristic (QC). Prudence will be discussed as a reinforcement of neutrality in the context of the QC of faithful representation.

The IPSASB also decided to add obscuring information to omitting and misstating information as factors that can influence the objectives of financial reporting - discharging accountability and decision making. Obscuring information by, for example, including immaterial disclosures can impair understandability.

The IPSASB decided the scope and the concept of a reporting entity in the Accounting and Reporting by Retirement Benefit Plans ED should be consistent with IAS 26, Accounting and Reporting by Retirement Benefit Plans. The IPSASB also decided the ED should require retirement benefit plans to prepare a statement of financial position, a statement of change in net assets available for benefits, a cash flow statement, notes to the financial statements and information on the changes of pension obligations.

The next full-meeting of the IPSASB will take place virtually in September, 2021. For more information, or to register as an observer, visit the IPSASB website (www.ipsasb.org)